Helvetia increases volume, profits and dividend – Smile becomes European

24.03.2022 | Ad hoc announcement pursuant to Art. 53 LR

Video message from Philipp Gmür, CEO Helvetia Group

The most important details about the 2021 annual financial statements at a glance:

Profitable growth in all markets

- Helvetia was able to achieve profitable growth in the 2021 financial year and increase business volume to CHF 11,222.2 million.

- This was driven by broad-based organic growth in the non-life business and investment-linked insurance products in the life business. Caser's first full financial year as part of Helvetia also made a significant contribution.

- Helvetia increased its IFRS net income after tax to CHF 519.8 million (2020: CHF 281.7 million).

- The solid development of the technical results, Caser's outstanding profit contribution of around CHF 72 million and the excellent investment results led to an increase in earnings.

Dividend increase of 10%

- The Board of Directors will propose to the Shareholders' Meeting that the dividend be raised by 10% to CHF 5.50 per share.

- This dividend increase reflects the successful business performance and the strengthening of Helvetia's earnings power thanks to the takeover of Caser.

Smile to be launched in Austria, then in other Helvetia markets

- The leading Swiss online insurer Smile has performed very well, achieving growth of 12%, which is significantly above the market. Helvetia will now launch Smile's successful business model in the European country markets.

- The first country will be Austria. The goal is to establish Smile as the leading online insurer in this market by the end of the strategy period.

With regard to sustainability, Helvetia aims to obtain an MSCI rating of at least 'A'

- With its Sustainability Strategy 20.25, Helvetia is focusing on the areas of the environment, products, responsible investments and embedding sustainability as an integral part of the corporate culture.

- Helvetia has set itself the goal of attaining an MSCI rating of at least 'A' by 2025.

"Helvetia can look back on a very successful financial year 2021. I am particularly pleased that we are delivering on what we promised with Caser. This will benefit our shareholders in the form of a significant increase in the dividend. Customers in our European markets will also be able to take advantage of Smile's successful business model in the future. With these steps, we are continuing on our path towards becoming a European financial services provider, in line with the helvetia 20.25 strategy", says Philipp Gmür, Group CEO of Helvetia, about the very good result.

Solid technical results, substantial profit contribution from Caser and good investment results

IFRS net income after tax increased in the 2021 financial year to CHF 519.8 million (2020: CHF 281.7 million). The profitable growth, Caser's substantial profit contribution of around CHF 72 million and the very good investment result were the key drivers of the increase in profits.

In the non-life business, IFRS net income after tax rose sharply year-on-year to CHF 389.3 million (2020: CHF 258.5 million). The result of the life business improved considerably relative to the previous year to CHF 304.1 million (2020: CHF 167.1 million). The result from the "Other activities" business area stood at CHF -173.6 million in 2021 (2020: CHF -143.9 million).

Attractive dividend increase of 10%

The Board of Directors will propose to the Shareholders' Meeting that the dividend be raised by 10% over the previous year to CHF 5.50 per share. The shareholders will thus benefit from the good 2021 financial year and the successful acquisition of Caser, coupled with the associated strengthening of Helvetia's earnings power and dividend capacity.

Business volume exceeds 11 billion

In the 2021 financial year, the Helvetia Group advanced its focused growth path as per the strategy and recorded significant and profitable gains, in particular in the non-life and investment-linked life businesses. In total, the business volume amounted to CHF 11,222.2 million (2020: CHF 9,713.6 million). The organic growth of 5.8% (in original currency) was extremely positive. In addition, Caser's first full financial year as part of Helvetia contributed to the growth, accounting for around 60% of it.

The non-life business, which posted growth of 22.0% (in original currency), made an encouragingly strong contribution. Helvetia recorded strong, broad-based organic growth across all sectors and country markets (+9.8% in original currency). Furthermore, the takeover of Caser also had a positive impact.

The life business recorded growth of 6.3% (in original currency). The business with capital-preserving, investment-linked products in individual life developed very well (+24.8% in original currency).

Helvetia took a significant step in terms of its income from fee and commission business, which increased by 56.0% (in original currency) compared to the previous year to CHF 354.4 million. This growth can be attributed to a strong organic performance of +13.2% in original currency as well as to Caser and its non-insurance businesses, especially in the healthcare sector. Caser contributed CHF 211.8 million to income from fee and commission business in the year under review.

Solid combined ratio despite weather-related claims

Between the end of June and mid-July, Europe experienced hail and heavy rainfall that led to losses on a scale not seen over the previous ten years. The large summer storms caused a total net claims burden of CHF 125.6 million (before taxes), mainly in Switzerland and Germany. This was also reflected in the net combined ratio, which rose slightly from the previous year to 94.8% (2020: 94.0%).

Robust new business margin in the life business within the target range

The new business margin stood at 2.5% (2020 without Caser: 2.6%) and was thus clearly within the target range of 2% to 3%.

Strong investment result

The investment result from Group financial assets and property amounted to CHF 1,831.3 million, more than double the previous year’s figure (2020: CHF 840.6 million), due to a significantly better contribution from gains and losses from investments. This includes stable current income from Group investments of CHF 882.5 million (previous year: CHF 888.5 million). The direct yield came to 1.6% (previous year: 1.7%).

Capitalisation remains strong

Helvetia's capitalisation remains strong. Helvetia estimates that its SST ratio stood at above 240% on 1 January 2022 (end of June 2021: 234%).

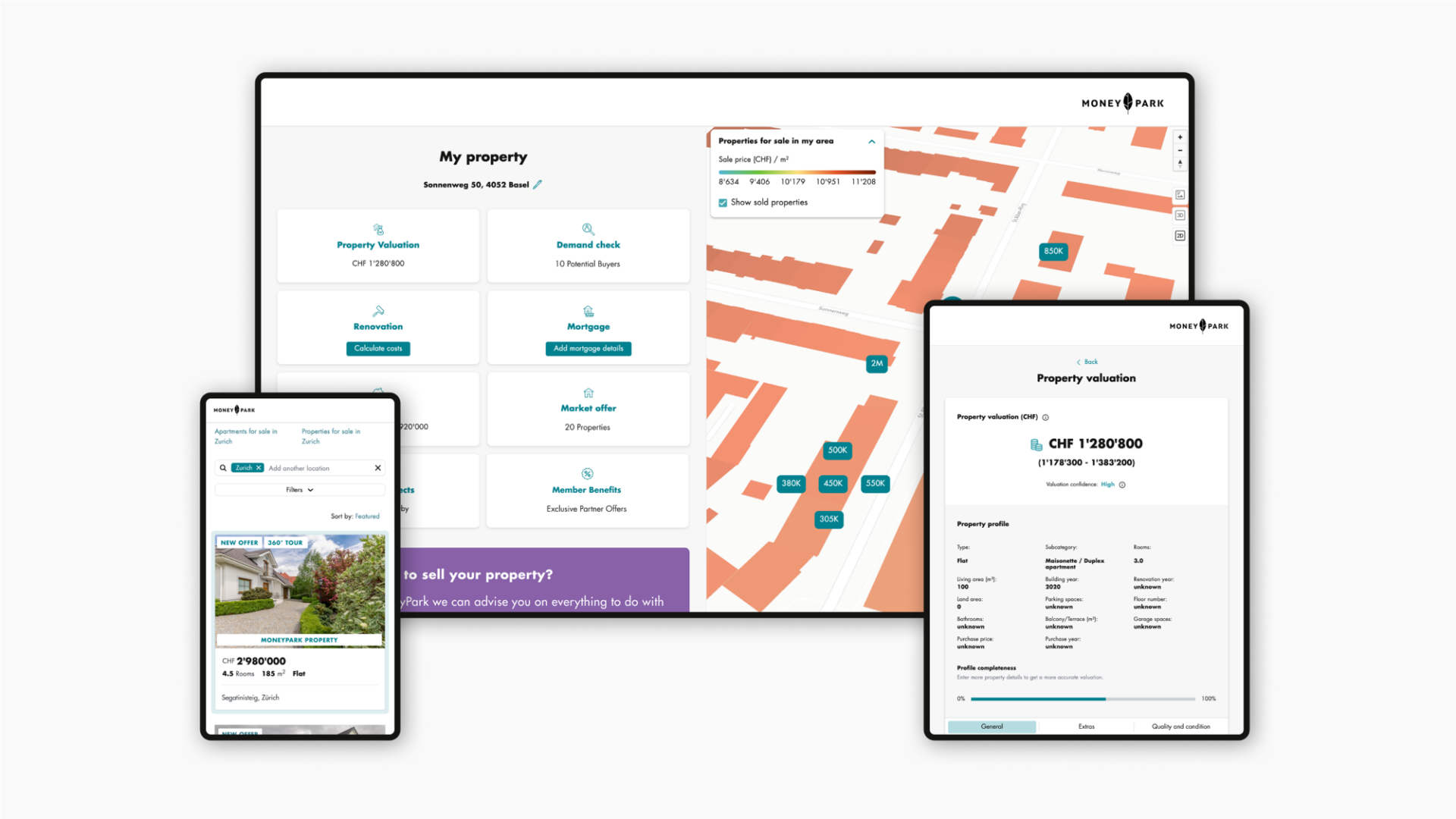

Smile becomes European and aims to become leading online provider in Austria

The first year of implementing the helvetia 20.25 strategy was very successful. Helvetia invested in particular in customer convenience, as the example of Smile demonstrates. The leading Swiss online insurer, Smile has developed rapidly, recording premium growth of 11.8% to CHF 111 million in 2021. Profitability was also very good, as is shown by the average net combined ratio of approximately 90% over the years 2016 to 2021. The basis for Smile's success is its positioning as a digital lifestyle brand. In 2021, for example, Smile was the first European insurer to launch a freemium model under which non-customers can also benefit from free services.

Helvetia will now expand Smile's unique model for success into the European country markets on a step-by-step basis. The first country will be Austria this year, followed by Spain in 2023. Philipp Gmür explains: "Customer demand for digital business models is increasing all the time. We want to take advantage of this trend and actively shape the development of online sales in our European country markets. Our first goal is to develop Smile into the leading online insurer in Austria by the end of 2025 thanks to the unique convenience it offers."

Helvetia sets itself an ambitious sustainability target

As a European financial services provider, Helvetia wants to contribute to the sustainable development of both the economy and society. The Sustainability Strategy 20.25 therefore focuses on the environment, products, investing responsibly and embedding sustainability as an integral part of Helvetia's corporate culture. An overriding goal of improving the MSCI rating to at least 'A' by 2025 is also being pursued.

Helvetia is able to build on various successes in this regard. Examples include the CO2 neutrality of Helvetia's own operations since 2017, the signing of the UN Principles for Responsible Investment in 2020 and the adoption of a responsible investment strategy in 2021. "The insurance business has a long-term focus. For that reason, sustainable action is part of our DNA. With our sustainability strategy, we are now setting ourselves targets in this area for the first time. By doing this, we are confident that we will both contribute to the development of the economy and society and create value for our customers, shareholders and employees", explains Philipp Gmür.

Elections to the Board of Directors

As announced at the end of 2021, Doris Russi Schurter will not stand for re-election as Chairwoman of the Board of Directors at the Shareholders' Meeting and Board member Christoph Lechner will not stand for re-election as a member. All other members of the Board of Directors will be recommended for election for an additional term of one year at the Shareholders' Meeting. Thomas Schmuckli will be recommended for election as the new Chairman of the Board of Directors, Luigi Lubelli for election as a new member.

Solid technical results, substantial profit contribution from Caser and good investment results

IFRS net income after tax increased in the 2021 financial year to CHF 519.8 million (2020: CHF 281.7 million). The profitable growth, Caser's substantial profit contribution of around CHF 72 million and the very good investment result were the key drivers of the increase in profits.

In the non-life business, IFRS net income after tax rose sharply year-on-year to CHF 389.3 million (2020: CHF 258.5 million). The result of the life business improved considerably relative to the previous year to CHF 304.1 million (2020: CHF 167.1 million). The result from the "Other activities" business area stood at CHF -173.6 million in 2021 (2020: CHF -143.9 million).

Attractive dividend increase of 10%

The Board of Directors will propose to the Shareholders' Meeting that the dividend be raised by 10% over the previous year to CHF 5.50 per share. The shareholders will thus benefit from the good 2021 financial year and the successful acquisition of Caser, coupled with the associated strengthening of Helvetia's earnings power and dividend capacity.

Business volume exceeds 11 billion

In the 2021 financial year, the Helvetia Group advanced its focused growth path as per the strategy and recorded significant and profitable gains, in particular in the non-life and investment-linked life businesses. In total, the business volume amounted to CHF 11,222.2 million (2020: CHF 9,713.6 million). The organic growth of 5.8% (in original currency) was extremely positive. In addition, Caser's first full financial year as part of Helvetia contributed to the growth, accounting for around 60% of it.

The non-life business, which posted growth of 22.0% (in original currency), made an encouragingly strong contribution. Helvetia recorded strong, broad-based organic growth across all sectors and country markets (+9.8% in original currency). Furthermore, the takeover of Caser also had a positive impact.

The life business recorded growth of 6.3% (in original currency). The business with capital-preserving, investment-linked products in individual life developed very well (+24.8% in original currency).

Helvetia took a significant step in terms of its income from fee and commission business, which increased by 56.0% (in original currency) compared to the previous year to CHF 354.4 million. This growth can be attributed to a strong organic performance of +13.2% in original currency as well as to Caser and its non-insurance businesses, especially in the healthcare sector. Caser contributed CHF 211.8 million to income from fee and commission business in the year under review.

Solid combined ratio despite weather-related claims

Between the end of June and mid-July, Europe experienced hail and heavy rainfall that led to losses on a scale not seen over the previous ten years. The large summer storms caused a total net claims burden of CHF 125.6 million (before taxes), mainly in Switzerland and Germany. This was also reflected in the net combined ratio, which rose slightly from the previous year to 94.8% (2020: 94.0%).

Robust new business margin in the life business within the target range

The new business margin stood at 2.5% (2020 without Caser: 2.6%) and was thus clearly within the target range of 2% to 3%.

Strong investment result

The investment result from Group financial assets and property amounted to CHF 1,831.3 million, more than double the previous year’s figure (2020: CHF 840.6 million), due to a significantly better contribution from gains and losses from investments. This includes stable current income from Group investments of CHF 882.5 million (previous year: CHF 888.5 million). The direct yield came to 1.6% (previous year: 1.7%).

Capitalisation remains strong

Helvetia's capitalisation remains strong. Helvetia estimates that its SST ratio stood at above 240% on 1 January 2022 (end of June 2021: 234%).

Smile becomes European and aims to become leading online provider in Austria

The first year of implementing the helvetia 20.25 strategy was very successful. Helvetia invested in particular in customer convenience, as the example of Smile demonstrates. The leading Swiss online insurer, Smile has developed rapidly, recording premium growth of 11.8% to CHF 111 million in 2021. Profitability was also very good, as is shown by the average net combined ratio of approximately 90% over the years 2016 to 2021. The basis for Smile's success is its positioning as a digital lifestyle brand. In 2021, for example, Smile was the first European insurer to launch a freemium model under which non-customers can also benefit from free services.

Helvetia will now expand Smile's unique model for success into the European country markets on a step-by-step basis. The first country will be Austria this year, followed by Spain in 2023. Philipp Gmür explains: "Customer demand for digital business models is increasing all the time. We want to take advantage of this trend and actively shape the development of online sales in our European country markets. Our first goal is to develop Smile into the leading online insurer in Austria by the end of 2025 thanks to the unique convenience it offers."

Helvetia sets itself an ambitious sustainability target

As a European financial services provider, Helvetia wants to contribute to the sustainable development of both the economy and society. The Sustainability Strategy 20.25 therefore focuses on the environment, products, investing responsibly and embedding sustainability as an integral part of Helvetia's corporate culture. An overriding goal of improving the MSCI rating to at least 'A' by 2025 is also being pursued.

Helvetia is able to build on various successes in this regard. Examples include the CO2 neutrality of Helvetia's own operations since 2017, the signing of the UN Principles for Responsible Investment in 2020 and the adoption of a responsible investment strategy in 2021. "The insurance business has a long-term focus. For that reason, sustainable action is part of our DNA. With our sustainability strategy, we are now setting ourselves targets in this area for the first time. By doing this, we are confident that we will both contribute to the development of the economy and society and create value for our customers, shareholders and employees", explains Philipp Gmür.

Elections to the Board of Directors

As announced at the end of 2021, Doris Russi Schurter will not stand for re-election as Chairwoman of the Board of Directors at the Shareholders' Meeting and Board member Christoph Lechner will not stand for re-election as a member. All other members of the Board of Directors will be recommended for election for an additional term of one year at the Shareholders' Meeting. Thomas Schmuckli will be recommended for election as the new Chairman of the Board of Directors, Luigi Lubelli for election as a new member.

Key figures

Contact information

Analysts

Philipp Schüpbach

Head of Investor Relations

Phone: +41 58 280 59 23

investor.relations@helvetia.ch

Philipp Schüpbach

Head of Investor Relations

Phone: +41 58 280 59 23

investor.relations@helvetia.ch